No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

In a nutshell, marketing automation refers to all the digital tools that help marketers reach customers more efficiently, effectively and scalably. But what are the real differences between business that use marketing automation and those that don’t? We broke it down.

Marketing automation means fewer people can effectively do the work of more. How? By helping marketers to be more efficient. The reason: with marketing automation software, almost no time is spent on repetitive “busy work” such as manually creating emails or responding to certain triggers. Imagine a world in which one employee has the same output and effectiveness as a team of 25.

One of the most powerful benefits that marketing automation offers marketers is the ability to reach customers in a personalised way – both online and offline – at scale.

Whether via phone, text, push notification, email and more, marketing automation makes it easy to deliver targeted messages to your customers at the right time, with zero hassle.

Without marketing automation, running targeted, multi-channel campaigns at scale is almost impossible.

There’s only so much time in a day. That’s why, traditionally, marketers test assets such as emails and landing pages only a handful of times before deploying them – and then leave it at that.

Marketing automation tools change everything. Suddenly, you can easily run ongoing A/B tests. That means constant feedback on performance and the ability to constantly iterate, change, and tweak, for optimal performance.

When using fragmented tools and platforms, reporting on marketing campaigns’ effectiveness can be time consuming and error-prone.

With marketing automation software, everything is simplified – summarised in a single place, no matter the channel. Suddenly, insights are available at a snap of the fingers.

Better yet, marketing automation platforms provide a bird’s-eye view of the entire marketing process. That helps reveal areas of drop off and complication easily, so you can fix problem spots quickly.

Do you know who your customers are? Do you fully understand their wants, needs and desires?

The best marketing automation tools use clever analytics and AI to break down your customers more granularly than would ever be possible otherwise. No matter how many customers you have, you can understand each of them individually, to provide them with the most effective, tailored messaging possible.

When your business has thousands or tens of thousands of leads, keeping track of engagements can be a daunting task. Marketing automation simplifies and streamlines the process, so that no interaction data is ever wasted, lost, or unaccounted for.

As your company expands, your marketing activities need to keep pace. Manual processes are difficult to scale. But automated processes scale instantly to fit as many customers and leads as they need to.

Sales take time and leads need nurturing. With marketing automation software, you can track campaigns’ effectiveness and respond to your prospective customers’ needs effectively at every stage of the buying journey.

In short, marketing automation makes marketing more effective, more reactive, more proactive, more scalable and more personalised. It frees up marketers’ time, so they can focus more on creative, ambitious ways of moving business forward. Finally, it primes companies for growth, as scaling is instant and automatic. No lags and no delays.

All this and more is possible with Dynamics 365 Marketing. Want to learn more?

Chat to us today to learn how to put these new features to work in your business.

Win customers and earn loyalty

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Has your inbox suddenly been flooded with mails all about POPIA, privacy and new legal changes? Ours certainly have been!

Now that the dust has settled a little, we’re posting to clarify any remaining questions you might have, and give you a helpful recap about what POPIA is, and what it means going forward.

Intro to POPIA

On July 1st 2021, South Africa’s new Protection of Personal Information Act (POPIA) came into force. With it, data, privacy and record-keeping requirements changed for thousands of organisations around South Africa. Not only for government entities and large corporates, but SMB’s, too.

In brief, the Protection of Personal Information Act (POPIA) is South Africa’s new data protection law. It’s aim is to protect individuals from harm by ensuring the their personal data is always handled correctly, prudently and with their consent.

To do this, the Protection of Personal Information Act lays out a number of specific conditions for when and how it is lawful for someone to process someone else’s personal information. It also places strict requirements on how that data is safeguarded and used.

![Data_security_31-[Converted]](/wp-content/uploads/2021/07/Data_security_31-Converted.jpg)

What do the requirements include?

The POPIA requirements cover factors such as accountability, processing limitations, information quality, openness, security safeguards, and data subject participation, among others.

Some of the basic principles include:

What is “personal information”?

For the purposes of the act, “personal information” means information relating to an identifiable, living natural person and, where applicable, an identifiable company or other similar legal entity.

Information about age, gender and race, identity numbers, telephone numbers, location information, online identifiers, and personal opinions and preferences are all included in the definition. Personal data on disabilities, physical or mental health, financial, criminal or employment histories are also included.

Who is affected by the act?

Any natural or juristic person who processes personal information – including large corporates and government – are affected. Currently, SMEs are also included.

What steps do companies have to take to comply with the act?

There are various requirements placed on companies by POPIA. Among them are the need to:

At The CRM Team, we’ve always been committed to the strictest client confidentiality and data security protocols. You trust us with your personal data, and we work hard to keep that data secure. With the passage of POPIA, we’re doubling down on that promise, to ensure your personal information is always used appropriately, transparently and in accordance with the applicable laws.

If you have any further questions about POPIA or want to get your business compliant, feel free to get in touch.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

In the competitive world of business today, customers expect a lot from businesses. Not only do they demand high-quality goods and services but they want high-quality experiences to accompany them.

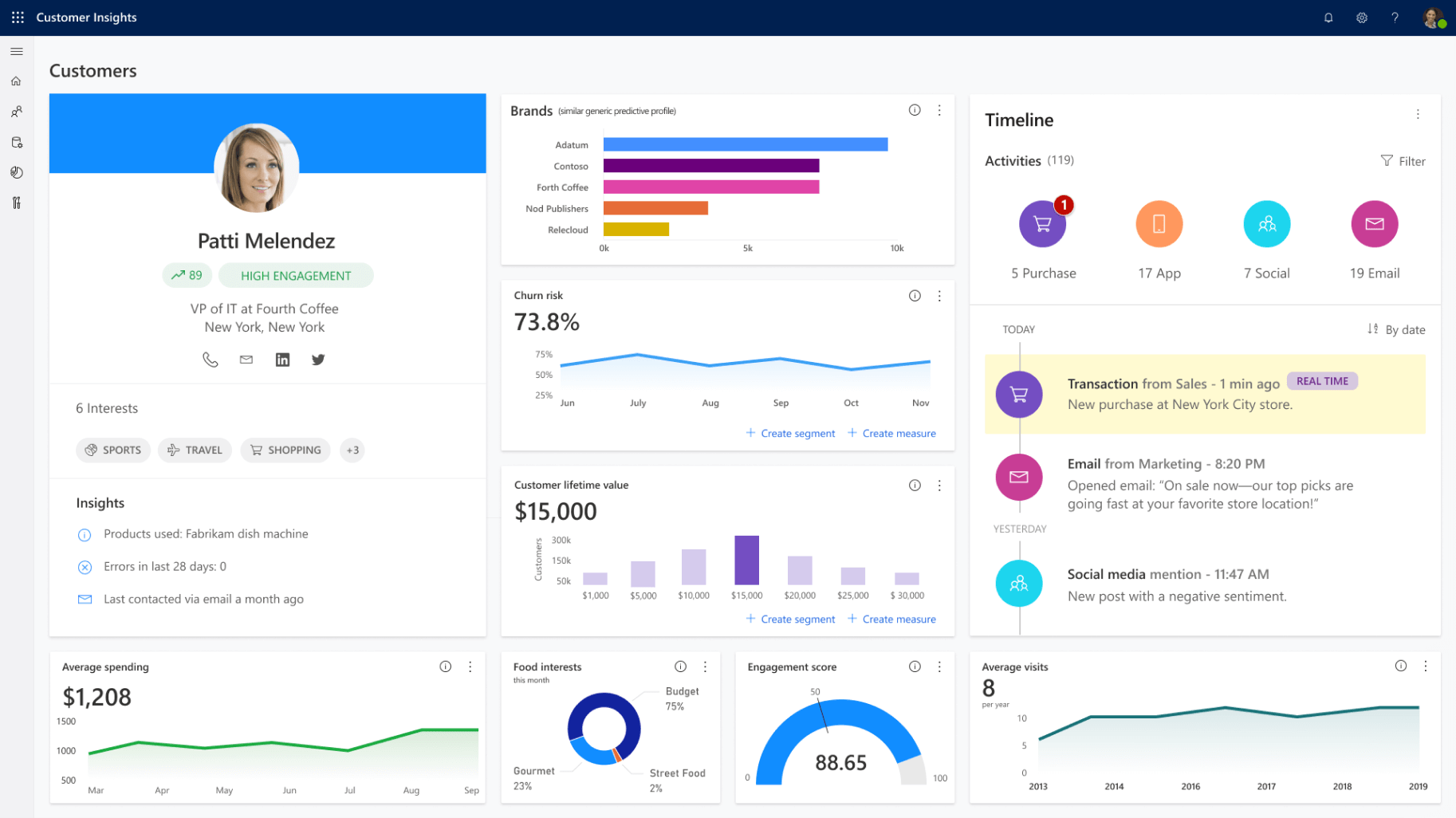

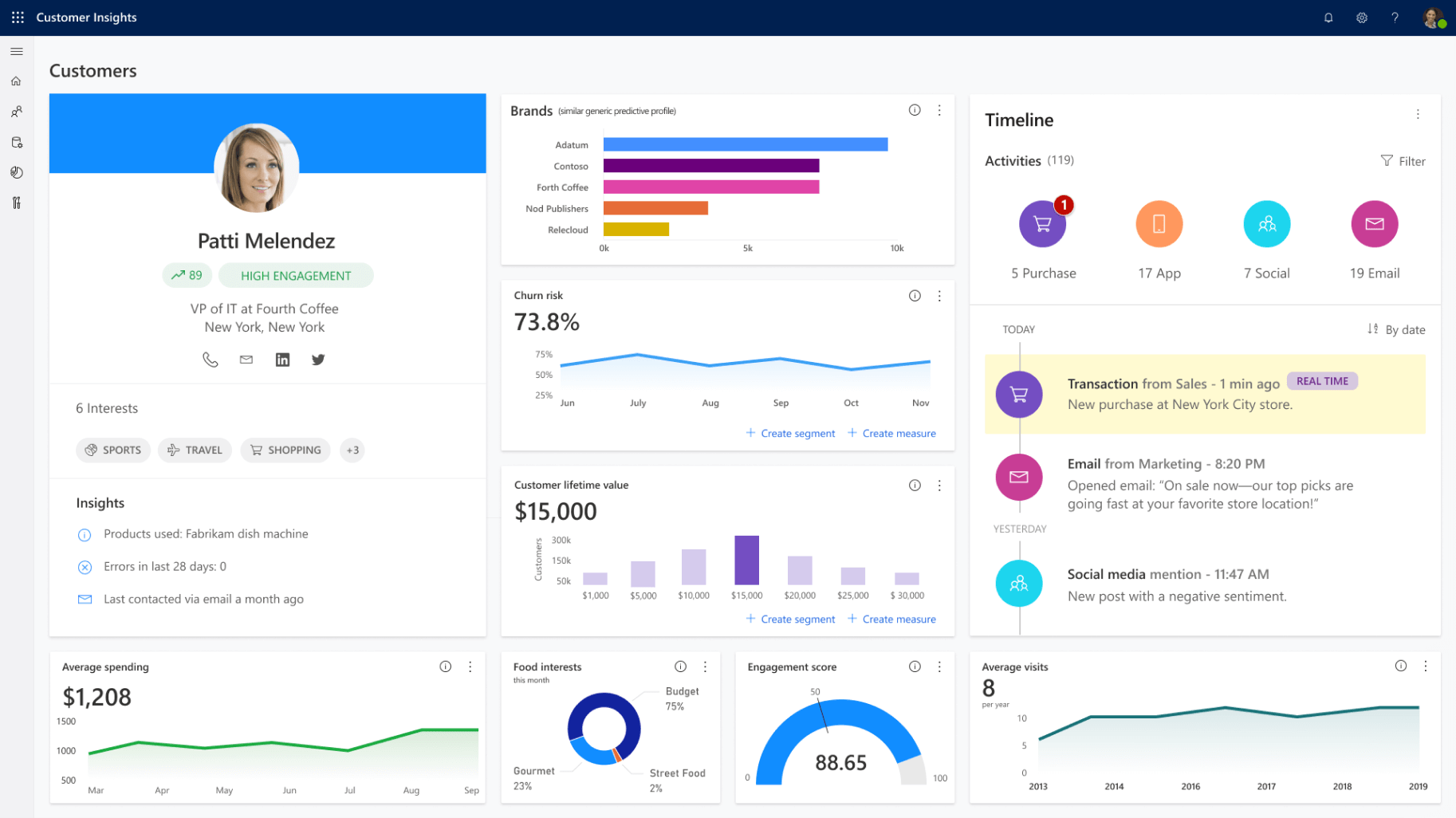

Customer insights are the tools forward-thinking businesses use to make sure every aspect of their business delivers on customer expectations. This spans everything from core products and services to the sales cycle, after-sales service, marketing activities and more.

At a basic level, customer insights are the ways companies use and interpret customer data, behaviours, and feedback to improve product/service development and enhance customer support.

They are crucially important because they not only help businesses serve their customers better, but they help businesses understand customer behaviour when it comes to purchasing decisions. By understanding how customers think and feel, what their goals and preferences are, and what they’re looking for in the brands they use, companies can make a genuine difference in customers’ lives and be rewarded with loyalty and growing revenue.

At a practical level, customer insights can help brands answer key business questions such as:

Gallup research shows that organizations that leverage customer behavioural insights outperform peers by 85 percent in sales growth and more than 25 percent in gross margin. And according to Microsoft, “A moderate increase in customer experience generates an average revenue increase of $775 million over three years for a company with $1 billion in annual revenues.”

Benefits of using customer insights

By using customer insights to inform strategic and tactical decisions, you can develop deeper relationships with your customers, better understand the connected customer, and generate meaningful and quantifiable results. Other benefits of using customer insights include:

Tapping into Customer Insights

With Microsoft Dynamics 365 Customer Insights, you can leverage leading technology to better understand your customers and drive your business forward.

Customer Insights allows you to:

And more.

If you’d like to find out more about how to leverage Dynamics 365 Customer Insights in your business, get in touch with us and we’ll show you how.

Win customers and earn loyalty

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

It comes as no surprise that Covid-19 has been bad for the financial services industry in South Africa. In March 2021 Standard Bank reported a 51% decline in profit after tax and in October 2020 Nedbank estimated that their profits would drop by 72%.

In the face of this economic reality, financial services organisations need to be extremely selective as to where budgets are allocated. Never before has it been more important for projects to either improve operations or increase revenue.

We would like to answer this question by looking at two research papers that can help determine the focus areas for financial services for 2021 and beyond.

The first is an analysis from Microsoft in conjunction with Future Digital Finance, CXFS and Insights titled: “Customer experience in the 2021 financial services market”. In the research, it was found that Customer Experience is still a big focus for Financial Services organisations with 86% of organisations either maintaining their CX budget (48%) or increasing it (38%). It was also found that for the 41% of researched organisations that the CX budget amounted to roughly 50% of the overall budget.

So where is this budget being allocated within CX? The top three priorities were found to be: “Leveraging customer data for real-time personalization at the branch level”,“Creating a unified customer experience across physical and digital channels” and “Creating more digital self-service options for customers”.

This identified both the importance of the continued digital transformation of financial services as well as the ever-increasing value of data.

The second piece of research that we would like to highlight is a 2020 study by Accenture titled:“Making digital banking more human”.

This research showed that the unprecedented circumstances of 2020 added to the rapid uptake of digital banking. This is to be celebrated but it also leads to the threat of increased commoditisation and jeopardisation of trust. Why? It again comes down to data. On one hand, there is the use of data to differentiate financial service engagements. On the other, customers need to trust financial services organisations with increasing amounts of their personal information.

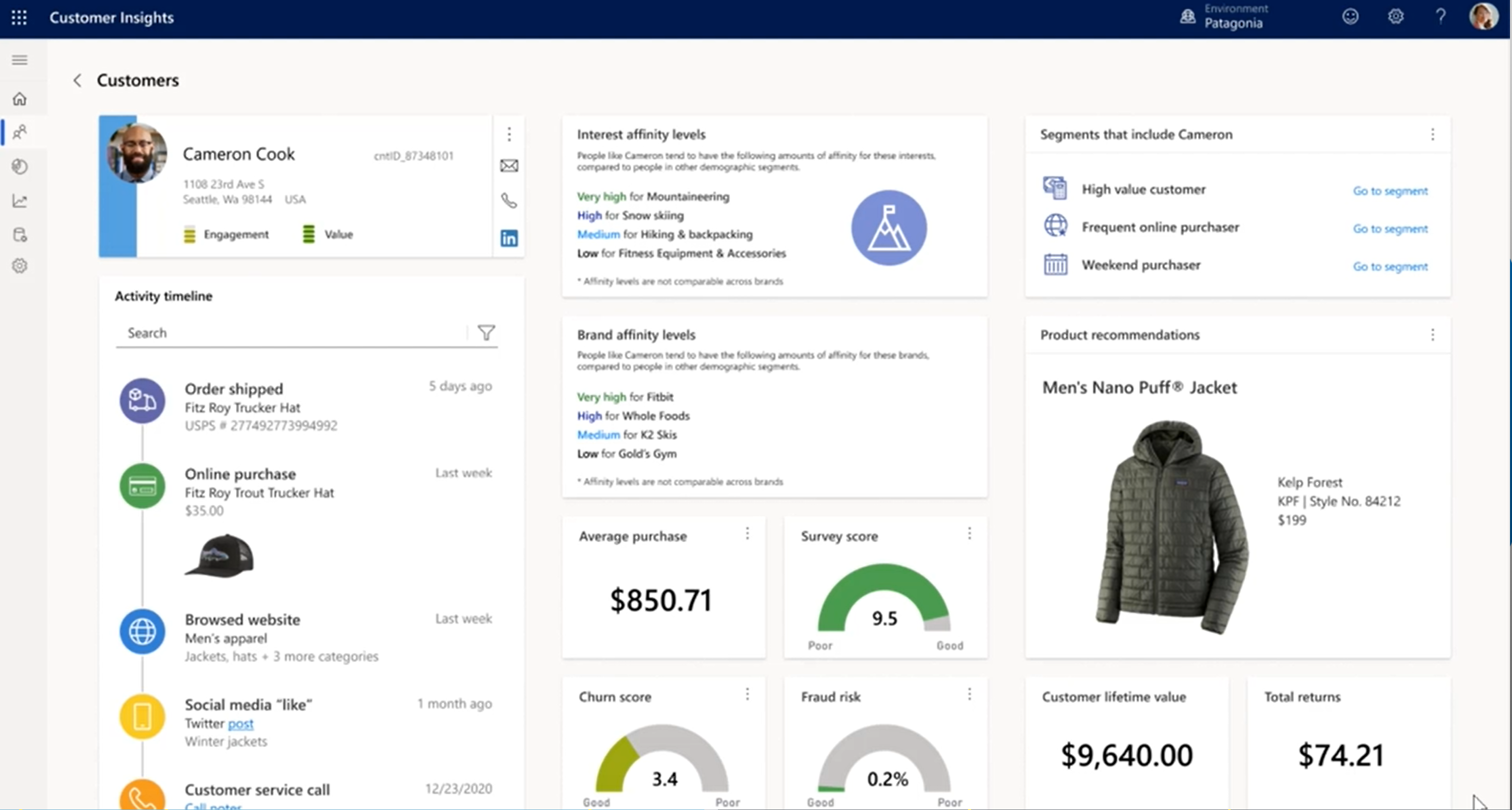

We have seen from the above research that data has become the new oil for financial services organisations. Of course, the drive to attain a single view of the customer has been something financial services organisations have been working hard to do for decades. In response, Microsoft has identified this as an area of importance and has introduced a solution: Microsoft Customer Insights.

As a technology solution, Customer Insights is state-of-the-art. It is developed as a pure out-of-the-box Software-as-a-Service (cloud) solution, it is easily configurable and extensible, and it can be embedded directly into your CRM of choice. With over 300 pre-built connectors, it can plug into data sources.

From an implementation perspective Microsoft Customer Insights can be implemented in weeks – not the months and years of traditional Customer Data Platform solutions. It is also run by business, often marketing, instead of being controlled and managed by IT.

From a financial services perspective, Microsoft Customer Insights provides the ability to personalise and tailor your products and interactions, to gain a competitive edge and optimise your engagements. Attaining this single view of the customer will give you near real-time insight into your customer, enabling you to get more revenue from marginal customers and even more from engaged customers.

Sasfin Wealth embarked on a technology drive with a focus on client experience. In order to provide a digital experience that added real value, they found that they needed to develop a deeper understanding of their clients’ interests, needs, wants and preferences.

Alex Elsworth, Chief Technology Officer at Sasfin Wealth, notes:

‘Our value proposition lies in the personal service and attention which we apply in managing our client portfolios. As a business philosophy, client relationships, client-orientated processes, client retention and superior client value are core to our offering.’

Both strategic and customer-focused elements were key parts of Sasfin’s CRM journey. The company wanted a central view of Wealth client information and the ability to track client interaction effortlessly. Essentially, Sasfin Wealth wanted to bring its ‘hands on’ client experience into the digital age.

‘During our research and evaluation, the Microsoft Dynamics 365 solution proved to be the platform that would best suit our needs and requirements,’ notes Tinus Verster, Wealth Technology Strategist at Sasfin. ‘Microsoft Dynamics 365 has the capability to integrate into existing backend systems. It is key to our digital strategy.’

Are you ready to start?

Are you ready to transform your data?

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

You know your business from the inside out. But what about from the outside in? Do you know how your customers experience your business? What they feel about your products and services? Whether your customer service works for them? Do you know how you could serve them better?

Many companies use analytics. But few use it as meaningfully as they could. An even smaller proportion use customer insights meaningfully. Yet by developing a deep understanding of how customers experience a product or service – how they feel about it, what they want, need, and desire – can make a massive difference to the present and future of every business.

With the right data, companies can take their businesses from good to great – or from great to amazing.

Here are some of the was you can leverage customer insights in your business

By understanding your customers’ wants and needs, you can reach them with messaging that they appreciate, understand and remember. If you’ve been frustrated by so-so marketing results, chances are your messaging is off. Or, you might be trying to reach the wrong people altogether. By knowing who you’re talking to, you can craft the kind of messages that matter.

Many businesses’ customer journeys are long and complex. Do they have to be? If the answer is no, customer insights can help businesses find new ways to simplify and streamline the customer experience. If the answer is yes, customer insights can help too – pointing out areas of frustration, drop-off and more, so companies can create the experience that works best.

Many new products and services fail. The reason is: customers don’t know about them, don’t want them, or don’t find them valuable. For any company thinking about a new product or service launch, customer insights can help answer key questions such as: whether customers feel a need for the new product; how they could imagine the product fitting into their lives; and what core wants/needs/desires the new product can help fulfill.

To make the most of customer insights data when trying to answer key business questions, it’s important to start out with a few points in mind.

Why Dynamics 365 Customer Insights works so well

Dynamics 365 Customer Insights was designed to make it easy to get every piece of customer information you have to work for your business.

With Dynamics 365 Customer Insights, you can:

And more.

To learn more about how Dynamics 365 can make a difference in your business, get in touch with us today.

Win customers and earn loyalty

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Recent Comments